At the Heart of the Numbers: What Is the Average Salary in Switzerland in 2025?

The year 2025 brings a new perspective on Swiss salaries compared to 2024. As the country continues to stand out for its high quality of life and strong economy, salary figures inevitably spark curiosity. In this article, we will dive into data from the Federal Statistical Office to break down the components of the average income. From regional contrasts between cantons to industry trends, economic factors, and demographic specifics, we will explore the many aspects that shape this financial reality. What is the true picture? Can salary alone justify relocating to Lausanne or Switzerland in general?

What Is the Actual Salary in Switzerland for 2024? Salary Calculator

The average Swiss salary is estimated at 5,503 CHF per month for the year 2024, which is equivalent to 5,747.03 EUR. This makes it the highest average salary in Europe. However, these figures need to be put into context. The concept of gross salary must be considered before any tax deductions or social security contributions.

To give you a clearer picture and help you compare your salary, here is a detailed table outlining salaries by industry in Swiss francs per month for 2024:

Here is the English translation of the salary table for 2024:

Average Monthly Salaries in Switzerland by Industry (2024)

| Industry | Profession | Average Monthly Salary (CHF) |

|---|---|---|

| Transport & Logistics | Train Driver | 6,055 CHF |

| Transport & Logistics | Maintenance Technician | 5,800 CHF |

| Transport & Logistics | Freight Forwarder | 5,057 CHF |

| Transport & Logistics | Cash-in-Transit Guard | 4,909 CHF |

| Transport & Logistics | Delivery Driver | 4,000 CHF |

| Legal Profession | Lawyer | 10,336 CHF |

| Legal Profession | Court Clerk | 8,902 CHF |

| Legal Profession | Legal Advisor | 8,355 CHF |

| Legal Profession | Notary | 7,999 CHF |

| Legal Profession | Bailiff’s Clerk | 5,783 CHF |

| Financial Sector | Financial Analyst | 8,448 CHF |

| Financial Sector | Banker | 7,500 CHF |

| Financial Sector | Financial Advisor | 7,487 CHF |

| Financial Sector | Broker | 7,000 CHF |

| Financial Sector | Accountant | 6,535 CHF |

| Public Service | Teacher | 6,923 CHF |

| Public Service | Social Worker | 6,892 CHF |

| Public Service | Urban Planner | 6,384 CHF |

| Public Service | Garbage Collector | 4,691 CHF |

| Public Service | Librarian | 4,300 CHF |

| Hospitality & Catering | Spa Manager | 9,859 CHF |

| Hospitality & Catering | Receptionist | 4,599 CHF |

| Hospitality & Catering | Cook | 4,345 CHF |

| Hospitality & Catering | Restaurant Employee | 4,283 CHF |

| Hospitality & Catering | Dishwasher | 3,700 CHF |

| Healthcare | Doctor | 9,972 CHF |

| Healthcare | Midwife | 6,689 CHF |

| Healthcare | Nurse | 5,769 CHF |

| Healthcare | Nursing Assistant | 5,106 CHF |

| Healthcare | Pharmaceutical Industry | 9,243 CHF |

| Healthcare | Pharmacy Technician | 4,695 CHF |

| Aviation & Air Transport | Pilot | 7,698 CHF |

| Aviation & Air Transport | Aviation Mechanic | 5,692 CHF |

| Aviation & Air Transport | Ground Staff Agent | 4,615 CHF |

| Aviation & Air Transport | Flight Attendant | 4,500 CHF |

| Aviation & Air Transport | Ramp Agent | 3,898 CHF |

| Commerce | Real Estate Agent | 6,205 CHF |

| Commerce | Store Manager | 5,769 CHF |

| Commerce | Salesperson | 4,999 CHF |

| Commerce | Visual Merchandiser | 4,807 CHF |

| Commerce | Call Center Agent | 4,461 CHF |

| Media & Communication | Press Officer | 6,638 CHF |

| Media & Communication | Graphic Designer | 6,003 CHF |

| Media & Communication | Journalist | 5,740 CHF |

| Media & Communication | Community Manager | 5,384 CHF |

| Media & Communication | Web Designer | 5,000 CHF |

What Is the Median Salary in Switzerland?

This figure plays a crucial role. While the average salary is the sum of all salaries divided by the number of workers, the median salary represents the middle point, separating the upper and lower halves of the salary scale. This means it provides a more accurate picture of economic reality by minimizing the impact of extreme values. In 2024, the median salary in Switzerland is estimated at 6,110 CHF per month, which is 607 CHF higher than the national average salary. This gap highlights the unequal income distribution, with a significant portion of workers earning below the national average.

What About Salaries for Cross-Border Workers?

Among various professions, cross-border salaries hold a special place. This term refers to workers who live in neighboring countries but commute daily to work in Switzerland. These workers hold a G permit. As of this year, the average cross-border salary in the Geneva area is 4,368 CHF per month across all industries. French nationals, for example, are often willing to accept lower wages than Swiss residents, which explains the gap between their earnings and the national average. Since the cost of living in France is significantly lower, many cross-border workers are satisfied with minimum wages and basic health insurance coverage.

Advantages for Cross-Border Workers

- Access to a strong and dynamic Swiss job market.

- Stable employment opportunities.

- Very low unemployment rates.

- Lower daily living and housing costs in their home country.

Disadvantages

- Longer and more expensive commutes between home and work.

- Cross-border tax complexities.

- Potential currency exchange rate fluctuations.

You can easily calculate your salary using the Salarium tool from the Federal Statistical Office (FSO). This tool provides a gross salary estimate based on precise factors such as industry, canton, work experience, and more.

Monthly Salary by City

Within Switzerland’s economic ecosystem, average salaries vary significantly across different regions. Salaries fluctuate depending on the city of residence. To better understand these differences, let’s take a closer look at the average salary by city. The cantons of Zurich and Bern have the highest monthly income because senior executives are most prevalent there.

| Cities | Average Salary (CHF) |

|---|---|

| Zurich | 6’100 |

| Genève | 5’950 |

| Bern | 5’350 |

| Lausanne | 4’580 |

| Montreux | 4’650 |

| Winterthour | 4’190 |

| Davos | 4’290 |

| Coire | 4’000 |

Is the Minimum Wage Different Across Cantons?

In Switzerland, the minimum wage is set at the cantonal level rather than nationally. Not all cantons have established a minimum wage for employees. As of now, only five regions have implemented a minimum wage: Geneva, Basel-City, Jura, Neuchâtel, and Ticino. These cantons introduced a minimum wage to provide a safeguard against the high cost of living.

Minimum wage levels vary between cantons due to factors such as:

- Cost of living

- Economic activity and growth

- Presence of key industries

- Local regulations and policies

For example, cities like Zurich, Geneva, and Basel-City tend to have higher average salaries due to their high concentration of international companies and thriving industries.

Table of Cantonal Minimum Wages

| Canton | min salary 2024 |

|---|---|

| Genève | 4’368 CHF |

| Bâle-Ville | 3’822 CHF |

| Neuchâtel | 3’780 CHF |

| Jura | 3’749 CHF |

| Tessin | 3’458 CHF |

Are Minimum Wages Different Across Cantons?

In Switzerland, the minimum wage is set at the cantonal level, not the national level. Not all cantons have a mandatory minimum wage. Currently, Vaud, Solothurn, Basel-Landschaft, and Valais are also considering implementing a minimum wage, with ongoing discussions to determine the specifics.

At the same time, the introduction of salary scales in Geneva and Vaud, along with the revision of Vaud’s pay structure, reflects the commitment of these regions to establishing fair wage standards for workers.

Understanding Salary Levels: Explanation of Wage Classes

In Switzerland, salary classifications can vary between companies, but a structured ranking system exists based on criteria such as experience, skill level, and job responsibilities.

This classification includes 18 salary levels, with each job position assigned to a specific category. Salaries range from the minimum to the maximum wage, with a 45% difference between the two—except for classes 1 and 2, which represent the minimum wage. You can find an example of this distribution on the Vaud canton’s website.

Each salary class is further divided into 26 steps across three different zones:

- In the first zone, each increase equals 2.44% of the class minimum salary.

- In the second zone, each increase represents 1.67%.

- In the third zone, each increase accounts for 1.17%.

Collective Labor Agreements (CCTs)

Collective labor agreements (CCTs) play a crucial role, especially in cantons that do not have a legally established minimum wage. These agreements define salary conditions and serve as essential frameworks for ensuring fair pay across different industries.

Since there is no uniform national wage law, CCTs act as regulatory mechanisms, shaping fair work environments through collaboration between employees and employers.

CCTs cover a wide range of topics, including:

- Salaries

- Working hours

- Paid leave

- Severance pay

- Employee benefits

Industries Without Collective Agreements

While many sectors benefit from collective labor agreements, some industries remain uncovered. Here are a few examples:

- Movers

- Delivery drivers

- Small businesses (due to their limited size, they often lack specific agreements)

- Self-employed professionals

- Emerging professions that do not yet fit into existing agreements

List of Unions Offering Solutions

Several Swiss labor unions negotiate collective labor agreements:

- Unia: The largest labor union in Switzerland. Their website provides access to over 100 collective agreements, benefiting 1.3 million employees.

- Swiss Trade Union Federation (USS): A national umbrella organization that negotiates CCTs in public services, healthcare, education, and other sectors.

- Syna: Represents workers in commerce, retail, logistics, and hospitality.

- SEV (Transport Workers’ Union): Covers the railway and road transport industries.

- Syndicom: Focuses on media, telecommunications, postal services, and cultural industries.

What Are the Requirements for a CCT?

To establish a collective labor agreement, several conditions must be met:

- Union Representation – A labor union must advocate for employees and negotiate on their behalf.

- Employee Demand – Workers can request a CCT through petitions or surveys.

- Workplace Conflicts – Agreements may be negotiated in response to ongoing disputes between employees and employers.

- Legal Approval – Once finalized, the agreement must be validated by cantonal authorities.

A High Quality of Life, but at What Cost?

Unlike in France, Switzerland’s economic landscape requires careful financial planning to maintain a comfortable standard of living. As of 2024, Switzerland has the highest cost of living in Europe, surpassing France by an average of 81%.

While Swiss salaries may seem attractive, understanding how these earnings align with daily expenses is essential. The costs of gasoline, dining out, entertainment, and housing are significantly higher than in France. For example, housing costs in Switzerland are 129% higher than in France—whether for renting an apartment in the city or booking a hotel stay.

Is Switzerland’s Minimum Wage the Highest in the World? A Reality Check

Examining Switzerland’s minimum wage system reveals a complex reality that differs from common perceptions. Key factors include:

- Longer Work Hours – In Switzerland, the maximum weekly work hours are 50, compared to 39 in France.

- Lower Social Contributions – In Switzerland, social security deductions range from 13% to 17% of gross salary, while in France, they are around 23%.

- Health Insurance Costs – Unlike in France, Swiss workers pay for their own health insurance, which adds a significant financial burden. On average, households spend €400 per month on health coverage.

Taxes: Differences Between Switzerland and France

Each country has developed distinct tax systems, affecting take-home pay differently. (Further comparison to follow.)

| Tax Type | France | Switzerland |

|---|---|---|

| Income Tax | Progressive up to 45% | Progressive up to 11.5% (varies by canton) |

| Wealth Tax | Yes, on total wealth | Yes, on total wealth |

| VAT (Standard Rate) | 20% | 7.7% (federal rate) |

| Corporate Tax | 28% | 12.32% (average rate) |

| Social Contributions | Yes, very high | Yes, varies by canton |

| Inheritance Tax | Progressive | Progressive up to 50% |

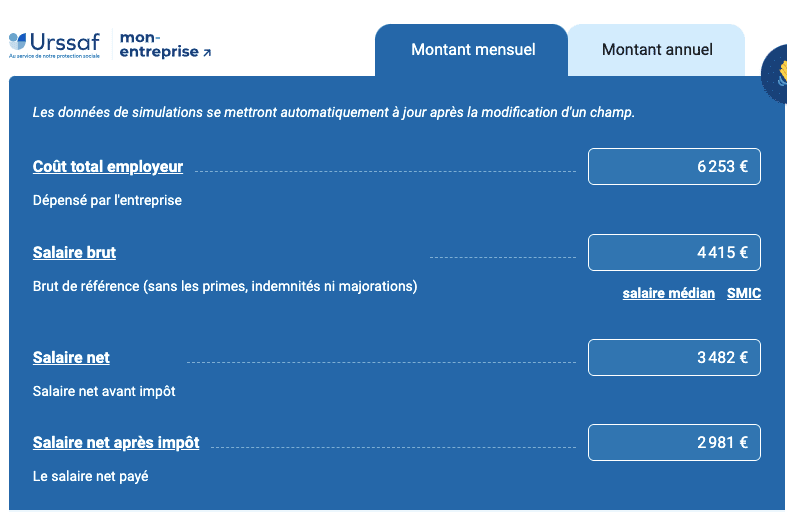

This difference in taxation largely explains the salary gap between France and Switzerland. If you earn the Swiss average salary for 2024 of 5,503 CHF, your employer’s total cost, including employer contributions, amounts to 6,253 CHF.

Understanding Gross vs. Net Salary in France and Switzerland

In France, the gross salary consists of the net salary plus employee contributions. However, to understand the actual cost to the employer, you must also include employer contributions, which are roughly equal to employee contributions.

According to Urssaf, if an employer in France pays 6,253 EUR, the employee takes home only 2,981 EUR after deductions. This stark difference highlights the impact of high social security contributions in France compared to Switzerland, where lower payroll taxes result in a significantly higher net salary for employees.

Understanding the Impact of VAT on Net Salary

After receiving your net salary, you also have to pay VAT (Value-Added Tax) on everything you spend. Since France has a VAT rate of 20%, the net income after VAT is:

2,981 EUR * 80% = 2,385 EUR.

In Switzerland, VAT is much lower at 7.7%, meaning the net salary after VAT is:

5,503 CHF * 92.3% (100 – 7.7) = 5,079 CHF.

This means that for the same employer-paid salary, a Swiss employee retains twice as much net income compared to a French employee.

However, working conditions also differ. Swiss employees generally have fewer vacation days, work 39-40 hours per week, and contribute to a capitalized pension system, meaning they save for their retirement throughout their career, and this money is invested and locked until retirement. This can be an advantage compared to France’s uncertain pension system.

Gross vs. Net Monthly Salary: Key Differences

As in many countries, the difference between gross and net salary lies in taxes and social contributions.

Switzerland, as a federal country, has different tax rates and social contributions depending on the canton, meaning the net salary can vary significantly from one region to another. For an accurate estimate, it’s best to consult a tax expert or use a Swiss salary calculator.

- Gross Salary: The total amount earned before any deductions. This is what the employer pays before deducting taxes, social contributions, and other mandatory deductions.

- Net Salary: The actual amount you receive after income tax, social security contributions, unemployment insurance, and other deductions.

Your industry, job profile, and location all affect these amounts.

Conclusion

In summary, examining the Swiss average salary for 2024 reveals a complex financial reality. Switzerland remains a highly attractive country in terms of salary, offering fair compensation for overtime and a smaller gender pay gap (18%) compared to France (24%).

Factors like cantonal differences, industry trends, and cost of living all play a role in shaping the financial landscape. Additionally, collective labor agreements (CCTs) help regulate wages, ensuring a fairer salary structure.

While the high salary figures in Switzerland are tempting, understanding all these factors can help individuals make an informed decision before moving.

So, are you ready to send your job application?

Sources:

Copyright CARBONIE DEMENAGEMENT 2025